Market for natural and synthetic diamonds in 2023

The year 2023 saw an interesting development in the diamond market, with a significant divergence in prices between synthetic and natural diamonds. Natural diamonds marked a decrease in prices due to normalization after the post-pandemic euphoria that had characterized the market already during 2021 with an increase in diamond jewellery retail of 29 percent (source: Bain & Company) given by consumers' desire to express themselves and seal important moments with precious gifts.

This increase was well beyond normal market values that have always maintained a gradual increase in natural diamonds over the long term. Even in 2023, natural diamonds animated the growing second-hand market, one of the most relevant trends of the 2020-2030 decade.

In fact, during the course of the year, the auction house world confirmed the continued interest of collectors in natural diamonds with rare characteristics and colorations, such as fancy pink and fancy blue, which registered notable sales: the Eternal Pink, which fetched $34.8 million at Sotheby's New York location, and the Blue Royal fetched $43.8 million at Christie's in Geneva last November.

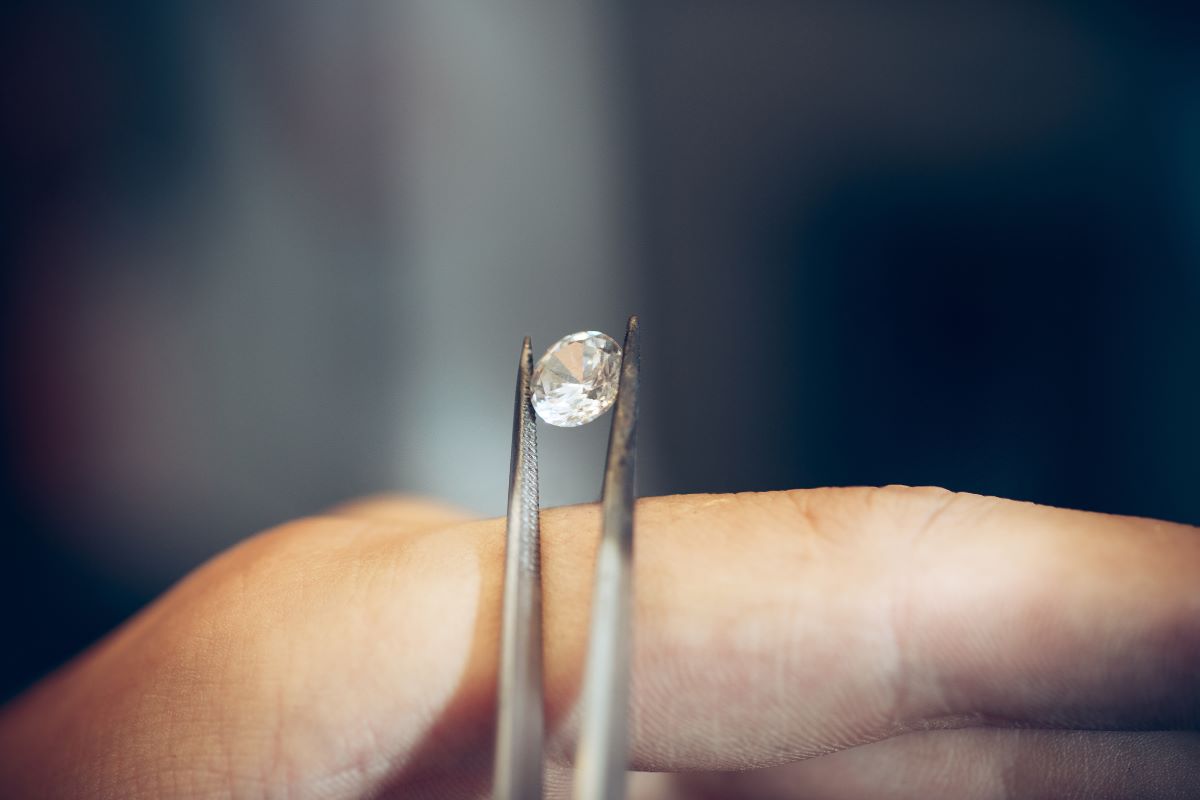

Synthetic diamonds, which are produced in laboratories, experienced a significant price decrease in 2023 due to increasing and unlimited production resulting from recent industrial technological innovations.The substantial decrease in prices of synthetic diamonds has highlighted that they do not hold their value in either the short or long term, unlike natural diamonds.

In addition, the disparity in pricing of synthetic diamonds, which are often deceptively compared with natural diamonds and advertised as ethical, are practices that may lead consumers to believe they are getting a bargain. However, synthetic diamonds can be up to 98 percent less valuable than natural diamonds, according to the Rapaport Price List.To safeguard the industry and consequently the market.

It is essential that consumers are aware and informed in their choice.